2020 Proxy Statement

Notice of Annual Meeting of Shareholders

Annual Meeting ◆ Wednesday, April 29, 2020

11:30 a.m. EDT

Hampton, New Hampshire

|

SCHEDULE 14A

(Rule14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement | ☐ Confidential, For Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |

☒ Definitive Proxy Statement | ||

☐ Definitive Additional Materials | ||

☐ Soliciting Material Under Rule14a-12 |

UNITIL CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11.

| 1. | Title of each class of securities to which transaction applies: |

| 2. | Aggregate number of securities to which transaction applies: |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4. | Proposed maximum aggregate value of transaction: |

| 5. | Total fee paid: |

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| 1. | Amount previously paid: |

| 2. | Form, Schedule or Registration Statement No.: |

| 3. | Filing Party: |

| 4. | Date Filed: |

2020 Proxy Statement

Notice of Annual Meeting of Shareholders

Annual Meeting ◆ Wednesday, April 29, 2020

11:30 a.m. EDT

Hampton, New Hampshire

|

March 20, 201731, 2020

Dear Fellow Shareholder,

I am pleased to invite you to attend theThe Unitil Corporation Annual Meeting of Shareholders. The meetingShareholders will be held on Wednesday, April 26, 2017,29, 2020, at 11:30 a.m., at the Company’sour corporate headquarters, 6 Liberty Lane West, Hampton, New Hampshire. This year, we are asking shareholders to vote on the election of fivethree directors, and on the ratification of the selection of independent registered public accountants. Also this year, shareholders will be presented with an advisory vote on executive compensation, and an advisory vote on the frequency of future advisory votes on executive compensation.

Your vote is very important. I encourage you to vote to ensure that your voice is represented at the meeting, and to play a part in the future of the Company.our future. The enclosed proxy materials provide important information about the Company to assist you with your voting decisions, as well as instructions to submit your vote.

I would like to thank you for choosing to invest in Unitil Corporation. The Company’sOur vision, statementmission and philosophyvalues reflect our deep commitment to our shareholders, customers, local communities and partners. We provide more than just electricity and gas services and products. Our talented and dedicated people are proud to provide for the necessities of life with the safe and reliable delivery of natural gas and electricity throughout New England.Energy for Lifelife is the statement of pride and commitment that we use to describe this philosophy.commitment.

On behalf of the directorsBoard of Directors and management of Unitil Corporation, thank you for your continued support and confidence in 2017.2020.

Sincerely,

Robert G. SchoenbergerThomas P. Meissner, Jr.

Chairman of the Board,

Chief Executive Officer and

President

|

Hampton, New Hampshire March |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

The Board of Directors and management of Unitil Corporation (the “Company”) is pleased to invite you to attend the 20172020 Annual Meeting of Shareholders which will be held at the office of the Company, 6 Liberty Lane West, Hampton, New Hampshire, on Wednesday, April 26, 2017,29, 2020, at 11:30 A.M.a.m. for the following purposes:

| 1. | Election of |

| 2. | Ratification of the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for |

| 3. | Approval, on an advisory basis, of the compensation of the Company’s named executive officers; and |

| 4. |

| Transaction of any other business as may properly be brought before the meeting. |

The Board of Directors set February 21, 201720, 2020 as the date for determining holders of record of common stock who are entitled to notice of and to vote at the meeting or at any adjournments or postponements of the meeting. The Board of Directors has directed the Company to prepare this notice, the accompanying proxy statement, and the accompanying annual report, and to send them to you.

By Order of the Board of Directors,

Sandra L. Whitney

Corporate Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON WEDNESDAY, APRIL 29, 2020 This notice, the accompanying proxy statement and the accompanying annual report to shareholders are available for shareholders to view atwww.proxydocs.com/UTL. |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON WEDNESDAY, APRIL 26, 2017 This notice, the accompanying proxy statement and the accompanying annual report to shareholders are available for shareholders to view at www.proxydocs.com/UTL.

|

YOUR VOTE IS VERY IMPORTANT

Your vote is important. To ensure a quorum is present at the Annual Meeting of Shareholders, please be sure your shares are represented at the meeting.

You may vote in one of the following ways:

| Shareholders of Record | Beneficial Owners | |||||||

By Mail

| Sign, date and return the enclosed proxy card (a self-addressed envelope is enclosed for your convenience)

| By Mail

| Direct your bank, broker or other nominee on how to vote your shares in accordance with the instructions provided to you | |||||

Via the Internet

|

Submit your proxy atwww.investorvote.com/UTL |

Via the Internet

| ||||||

In Person at the Meeting

Please see the Notice below. |

A meeting ballot will be provided for voting at the meeting |

In Person at the Meeting

Please see the Notice below. |

A legal proxy is required, which can be obtained from your bank broker or other nominee; a meeting ballot will be provided for voting at the meeting

| |||||

If for any reason you desire to revoke or change your proxy, you may do so at any time prior to the meeting by following the procedures described in the accompanying proxy statement or in person at the meeting.

| If for any reason you desire to revoke or change your voting instructions, you must contact your bank, broker or other nominee and follow its procedures for revoking or changing your voting instructions. | |||||||

ATTENDING THE ANNUAL MEETING OF SHAREHOLDERS

Please see the Notice below.

All shareholders who wish tomay attend the Annual Meeting of Shareholders in person are encouraged to do so.Shareholders. However, to ensure that the meeting remains orderly and secure, you must follow certain protocols for admittance. Shareholders of record will need to provide their admission ticket or their name and government-issued picture identification. Beneficial owners will need to provide a copy of an account statement from the bank, broker or nominee holding the shares as proof of ownership as of the Record Date, as well as government-issued picture identification.

|

NOTICE REGARDING CORONAVIRUS(COVID-19) GLOBAL PANDEMIC The World Health Organization has declaredCOVID-19 a global pandemic. We are required by the New Hampshire Business Corporation Act to hold our 2020 Annual Meeting. However, we believe encouraging a large group gathering at our meeting would not be prudent or socially responsible due to the evolving public health impact ofCOVID-19. For your safety and the safety of others, we respectfully request that you seriously consider the impactof COVID-19 in deciding whether to attend the meeting. We will report the voting results of the meeting in a press release or filing with the Securities and Exchange Commission. Unlike in recent years, this year only those officers who are essential to the business of the meeting will attend the meeting in person, and we will not provide a shareholder presentation after the formal business of the meeting. We encourage you to vote your shares using one of the methods described above to ensure that your voice is represented at the meeting. Your vote is very important. If you have any questions, please contact us atInvestorRelations@unitil.com or by calling toll free800-999-6501. |

|

PROXY STATEMENT

| INFORMATION ABOUT THE ANNUAL MEETING | 1 | ||||

| 8 | |||||

| SHARE OWNERSHIP | 9 | ||||

| 15 | |||||

| 16 | |||||

| 16 | |||||

| 16 | |||||

| 17 | |||||

| 18 | |||||

| 18 | |||||

| 19 | |||||

| 21 | |||||

| 22 | |||||

| 23 | |||||

| 25 | |||||

| 28 | |||||

| 31 | ||||

| 54 | |||||||

Election of Three Directors in Class II for a Term of Three Years | |||||||

Approval, on an Advisory Basis, of the Compensation of the Company’s Named Executive Officers | |||||||

| |||||||

|

Unitil Corporation

6 Liberty Lane West

Hampton, NH 03842-1720

March 20, 201731, 2020

PROXY STATEMENT

Unitil Corporation (“Unitil” or the “Company”) is providing this proxy statement and the accompanying annual report (which includes the Company’s Annual Report on Form10-K for fiscal year 2016)2019) to shareholders in connection with the Company’s 2017our 2020 Annual Meeting of Shareholders (the “Annual Meeting”). The Company’sUnitil’s Board of Directors (the “Board”) is soliciting your designation of a proxy to vote your shares at the Annual Meeting. As a shareholder of the Company,Unitil, you are invited to attend the Annual Meeting, as well as entitled and requested to vote (if you are a shareholder of record) or to provide voting instructions (if you beneficially own your shares in street name) on the proposals described in this proxy statement. This proxy statement provides information to assist you in voting your shares or in providing voting instructions with respect to your shares.

The CompanyUnitil has the following subsidiaries, which are referred to throughout this proxy statement: Fitchburg Gas and Electric Light Company (“Fitchburg”); Granite State Gas Transmission, Inc. (“Granite”); Northern Utilities, Inc. (“Northern”); Unitil Energy Systems, Inc. (“Unitil Energy”); Unitil Power Corp.; Unitil Realty Corp.; Unitil Resources, Inc.; and Unitil Service Corp.; and Usource, Inc. and Usource, LLC (collectively, “Usource”).

We may also refer to Unitil as “we” or “our” or “us” throughout this proxy statement.

INFORMATION ABOUT THE ANNUAL MEETING

|

Date, Time and Place

The Annual Meeting will be held on Wednesday, April 26, 201729, 2020 at 11:30 A.M. at theour corporate office, of the Company, 6 Liberty Lane West, Hampton, New Hampshire.Hampshire 03842-1720.

Anticipated Mailing Date

The Company anticipatesWe anticipate first mailing definitive copies of this proxy statement, the accompanying proxy card, and the accompanying annual report to shareholders on or about March 20, 2017.

|

1

MEETING SUMMARY

This year, we are seeking your vote on the following proposals:

| 1) | Election of |

| 2) | Ratification of the selection of Unitil’s independent registered public accounting firm, Deloitte & Touche LLP, for fiscal year |

| 3) | Approval, on an advisory basis, of the compensation of the Company’s named executive officers. The Board recommends a vote FOR this proposal. Information on Proposal No. 3 is included in the section entitledProposal 3: Approval, on an Advisory Basis, of the Compensation of the Company’s Named Executive Officers. |

| 4) |

| Transaction of any other business that may properly be brought before the Annual Meeting. |

RECORD DATE & NUMBER OF SHARES OUTSTANDING

You are entitled to receive notice of and to vote at the Annual Meeting if you owned shares of the Company’s common stock as of the close of business on February 21, 2017 (the “Record Date”). As of the Record Date, the Company had 14,101,963

| RECORD DATE & NUMBER OF SHARES OUTSTANDING | ||||||

You are entitled to receive notice of and to vote at the Annual Meeting if you owned shares of Unitil common stock as of the close of business on February 20, 2020 (the “Record Date”). As of the Record Date, there were 14,960,124 shares of common stock issued and outstanding and entitled to vote at the Annual Meeting. | Record Date February 20, 2020 Shares Outstanding 14,960,124 |

QUORUM & REQUIRED VOTE

A majority of the outstanding shares of common stock entitled to vote at the Annual Meeting must be present in person or represented by proxy to conduct the Annual Meeting. This is referred to as a quorum.

If a quorum is present, Directorsthe nominees standing for election as a Director will be elected by a plurality of the votes cast by the shareholders. Votes withheld and brokernon-votes will not be counted toward the achievement of a plurality. Additional information concerning the election of directors appears in the sectionsections entitled Corporate Governance – Resignation Policyand Proposal 1 – Election of Directors. With respect to all other matters that may come before the Annual Meeting, action on a matter is approved if the votes cast favoring the action exceed the votes cast opposing the action. Therefore, abstentions and brokernon-votes will have no effect on the other matters. Representatives of the Company’sour transfer agent will count the votes and certify the results.

|

2

VOTING RIGHTS AND PROCEDURES

As an owner of Unitil common stock, it is your legal right to vote (or to provide instructions on voting)voting instructions) on all matters to be considered at a shareholder meeting. Unitil hopesWe hope you will exercise your legal right and fully participate as a shareholder in the Annual Meeting. You may cast one vote for each share of common stock that you own on all matters presented at the Annual Meeting.

The Board has selected and approved Robert G. Schoenberger and Mark H. Collin

You may cast one vote for each share of common stock that you own on all matters presented at the Annual Meeting. The Board has selected and approved Thomas P. Meissner, Jr. and Laurence M. Brock as proxies for the Annual Meeting to vote your shares in the manner that you specify on the proxy card or via the Internet, or if you do not give any specification on your proxy card or submitted proxy with respect to a matter, FOR such matter. Your designation of a proxy will not affect your right to attend the Annual Meeting and vote in person. Record Holders If your shares of common stock were registered directly in your name with our transfer agent as of the Record Date, then you are considered a shareholder of record of the shares (a “Record Holder”) and we have sent the proxy materials and the accompanying proxy card directly to you. | Record Holders You may vote your shares in one of the following ways: in person at the Annual Meeting by designating another person (the “proxy”) to vote on your behalf by delivering a properly completed proxy card or submitting a proxy via the Internet atwww.investorvote.com/UTL You may revoke your designation of a proxy at any time before the vote is taken at the Annual Meeting in one of the following ways: file with Unitil’s Corporate Secretary a later-dated written notice of revocation deliver to Unitil’s Corporate Secretary a properly completed, later-dated proxy card relating to the same shares submit a later-dated proxy via the Internet if the original designation of a proxy was made via the Internet attend the Annual Meeting and vote

| |||

Beneficial Holders You may vote your shares in one of the following ways: in person at the Annual Meeting – but you must first obtain a properly completed legal proxy from your bank, broker or other nominee that will provide you with the right to vote the shares at the Annual Meeting direct your bank, broker or other nominee on how to vote your shares by following the instructions provided by the bank, broker or other nominee You may change how your bank, broker, or other nominee will vote your shares at any time before the vote is taken at the Annual Meeting: follow the procedures provided by your bank, broker or other nominee to make a change | Beneficial Holders If your shares of common stock were registered in the name of a bank, broker or other nominee as of the Record Date, then you are considered a beneficial owner (“Beneficial Holder”) of the shares that are registered in street name and your bank, broker or other nominee has sent this proxy statement and voting instructions to you. As a Beneficial Holder, your shares may be voted even if voting instructions are not provided. |

|

3

Brokerage firms have the authority under New York Stock Exchange rules to vote shares for which their customers do not provide voting instructions on routine matters. The ratification of the selection of Unitil’sour independent registered public accounting firm, Deloitte & Touche LLP, for fiscal year 20172020 is considered a routine matter. When a proposal is not routine and the brokerage firm has not received voting instructions from its customers, the brokerage firm cannot vote the shares on that proposal. Those shares are considered “brokernon-votes.” Please note that, under the New York Stock Exchange’sExchange rules, this means that brokers may not vote your shares on Proposals 1 3 and 43 at the 20172020 Annual Meeting if you have not given specific instructions as to how to vote to the broker. Please be sure to give specific voting instructions to your broker so that your vote can be counted.

|

4

A MESSAGE FROM THE CHAIRMAN AND CEO

This is a dynamic and exciting time for our industry, and the last 10 years have been truly transformational for both our Company and the industry as a whole. As a company, we are taking important steps to prepare for the future by aligning our strategies with the goals and aspirations of our stakeholders, as well as with our sustainability and corporate responsibility priorities. Our Vision isto transform the way people meet their evolving energy needs to create a clean and sustainable future.We fully support the transition to clean energy and believe this is the best way to position our company for true sustainability and long-term success.

The ongoing trend toward decarbonized energy solutions for the energy, heating and transportation sectors continues to create new policy initiatives that shape our business. Alignment of our strategies has provided an opportunity to find new ways to support the energy initiatives all around us. We believe that our ongoing efforts to implement decarbonization and electrification policies will create new opportunities for us as we move toward lower carbon alternatives.

While public attention has been focused on the idea of energy transformation, other important industry drivers like public safety, grid resiliency and cyber security remain at the forefront of our efforts as well. Our 2020 Strategic Plan outlines how our Mission, Vision and Values find opportunities within these industry drivers and outline both a path forward for our organization and important, attainable milestones for the coming year.

Working to ensure the core elements of our business, including safety, reliability andtop-tier customer service, remain sustainable is an important focus for our Company. Our industry is evolving, and our Strategic Plan is designed to help position ourselves as part of the solution to long term policy goals for our region. As we focus on these initiatives, we believe the Company will be ideally positioned to succeed today and thrive for years to come.

Over the last decade, Unitil has grown and prospered like never before in our Company’s history. As we enter the 2020s and beyond, I have confidence that the initiatives and actions we are taking now to achieve both our Mission and our Vision will shape the successes of tomorrow. It is truly an exciting time to be a part of the energy industry, and I’m glad you are here with us to share in this journey. If the last decade is any indicator, the future is indeed bright.

| - | Thomas P. Meissner, Jr. |

March 31, 2020

|

5

VISION, MISSION & VALUES |

VISION Our Vision is to transform the way |

MISSION Our Mission is to safely and reliably |

VALUES Our values are grouped into four important components:Respect, Integrity, Stewardship and Excellence, otherwise known as “RISE”. Together, these value categories are central to assuring that customer experience, employee engagement and our corporate responsibilities support both our Vision and our Mission. |

ACTING ON OUR VALUES

As a company, our values are the guiding principles behind our actions, but they are only as good as they are meaningful and measurable. Our RISE values have long been part of our core identity, but renewed focus on their importance will guide our path to fulfillment of our commitment to deliver ‘energy for life’ and the achievement of our Vision of a clean and sustainable future for all of our stakeholders.

|

6

On January 29, 2020, we announced that the Board appointed Winfield S. Brown as a new Director, effective as of January 29, 2020. The addition of Mr. Brown is part of the Board’s normal succession planning process in anticipation of upcoming retirements of four long-serving members of the Board following the Annual Meeting. Mr. Brown will serve on the Board until the Annual Meeting, at which time he will be presented to shareholders for election to the Board. Expanded biographical information for Mr. Brown is included in the section entitledProposal 1: Election of Directors.

|

7

|

The table below shows Executive Officers’ biographical information as of the date of this proxy statement, including the Named Executive Officers, with the exception of Mr. Schoenberger. Biographical information for Mr. Schoenberger, who is a Director, as well as chairman of the Board, chief executive officer (“CEO”) and president of the Company, is included in the section entitledProposal 1: Election of Directors- Information About Directors With Continuing Terms of Office.Officers.

MANAGEMENT INFORMATION TABLE

Name and Principal Position

|

Age

|

Description

| ||

| ||||

Thomas P. Meissner, Jr.

| Mr. Meissner has been Unitil’s chairman of the Board, chief executive officer and president since April 2018. Mr. Meissner served as Unitil’s senior vice president and chief operating officer | |||

Todd R. Black Senior Vice President,

| Mr. Black has been Unitil’s senior vice president, external affairs and customer relations, | |||

| ||||

Laurence M. Brock

| Mr. Brock has been Unitil’s | |||

Christopher J. LeBlanc Vice President, Gas Operations | 53 | Mr. LeBlanc has been Unitil’s vice president of gas operations since January 2017. Mr. LeBlanc joined Unitil in 2000 and served as director of gas operations from 2008 until January 2017, and in several other gas operations management positions from 2000 until 2008. | ||

Christine L. Vaughan(2) Senior Vice President, Chief Financial Officer & Treasurer | 53 | Ms. Vaughan has been Unitil’s senior vice president, chief financial officer and treasurer since March 2019. Ms. Vaughan joined Unitil in January 2019 as Senior Vice President of Financial and Regulatory Services of the Company’s subsidiary, Unitil Service Corp. Prior to joining Unitil, Ms. Vaughan served as Vice President, Rates and Regulatory and Treasurer for Eversource Energy in Massachusetts, where she had been employed since 2004. | ||

Sandra L. Whitney Corporate Secretary | Ms. Whitney has been Unitil’s corporate secretary and secretary of the Board since February 2003. Ms. Whitney joined Unitil in 1990 and has also | |||

NOTES:

| (1) | Ms. Vaughan resigned as Senior Vice President, Chief Financial Officer & Treasurer of the Company on March 16, 2020. |

|

8

The following table sets forth information on the beneficial ownership of the Company’sour common stock as of the Record Date, by (i) each person known to the Companyus to be the beneficial owner of more than five percent of itsour common stock, (ii) each Director and nominee for Director, of the Company, (iii) each executive officer named in the Summary Compensation Table in the section entitledCompensation -Compensation of Named Executive Officers (the “Named Executive Officers”) and (iv) all Directors and executive officers (“Executive Officers”) of the CompanyUnitil as a group. Except as otherwise indicated, to the Company’sour knowledge, the beneficial owners listed have sole voting and sole dispositive power with respect to the shares beneficially owned by them. The address of each of Unitil’s Directors and Executive Officersexecutive officers is c/o Unitil Corporation, 6 Liberty Lane West, Hampton, New Hampshire 03842-1720.

| Name of Beneficial Owner | Common Stock | Restricted Stock Units | Percent of Class | ||||||||||||

5% Owners:

| |||||||||||||||

BlackRock, Inc.(1) | |||||||||||||||

55 East 52nd Street, New York, NY 10055

|

| 1,211,445

|

|

| —

|

|

| 8.10%

|

| ||||||

Renaissance Technologies | |||||||||||||||

800 Third Avenue, New York, NY 10022

|

| 937,600

|

|

| —

|

|

| 6.28%

|

| ||||||

The Vanguard Group(3) | |||||||||||||||

100 Vanguard Boulevard, Malvern, PA 19355

|

| 909,528

|

|

| —

|

|

| 6.09%

|

| ||||||

Directors:(4) (5)

| |||||||||||||||

Robert V. Antonucci

| 3,465 | 10,332 | * | ||||||||||||

Winfield S. Brown

| — | — | * | ||||||||||||

David P. Brownell

| 5,276 | 11,755 | * | ||||||||||||

Mark H. Collin

| 47,804 | — | * | ||||||||||||

Lisa Crutchfield

| — | 10,332 | * | ||||||||||||

Albert H. Elfner, III

| 9,088 | 12,171 | * | ||||||||||||

Suzanne Foster

| 1,101 | — | * | ||||||||||||

Edward F. Godfrey

| 4,691 | 10,332 | * | ||||||||||||

Michael B. Green

| 5,530 | 11,755 | * | ||||||||||||

Thomas P. Meissner, Jr.(6)

| 65,145 | — | * | ||||||||||||

Eben S. Moulton

| 20,801 | 11,755 | * | ||||||||||||

M. Brian O’Shaughnessy

| 16,619 | 11,755 | * | ||||||||||||

Justine Vogel

| 1,101 | — | * | ||||||||||||

David A. Whiteley

| — | 10,332 | * | ||||||||||||

| Name and Address of Beneficial Owner | Common Stock | Restricted Stock Units | Percent of Class | |||

5% Owners: | ||||||

BlackRock, Inc.(1) | ||||||

55 East 52nd Street, New York, NY 10055 |

1,059,442 |

— |

7.5% | |||

Frontier Capital Management Co., LLC(2) | ||||||

99 Summer Street, Boston, MA 02110 | 906,244 | — | 6.5% | |||

The Vanguard Group(3) | ||||||

100 Vanguard Boulevard, Malvern, PA 19355 | 764,682 | — | 5.4% | |||

Directors:(4) (5) | ||||||

Robert V. Antonucci | 3,465 | 6,155 | * | |||

David P. Brownell | 5,276 | 7,461 | * | |||

Lisa Crutchfield | — | 6,155 | * | |||

Albert H. Elfner, III | 9,088 | 7,461 | * | |||

Edward F. Godfrey | 4,691 | 6,155 | * | |||

Michael B. Green | 5,530 | 7,461 | * | |||

Eben S. Moulton | 20,801 | 7,461 | * | |||

M. Brian O’Shaughnessy | 15,923 | 7,461 | * | |||

Robert G. Schoenberger(6) | 138,646 | — | * | |||

Sarah P. Voll | 10,016 | — | * | |||

David A. Whiteley | — | 6,155 | * | |||

Named Executive Officers:(4) | ||||||

Robert G. Schoenberger(6) | 138,646 | — | * | |||

Mark H. Collin(7) | 42,918 | — | * | |||

Thomas P. Meissner, Jr.(8) | 35,131 | — | * | |||

Todd R. Black(9) | 24,056 | — | * | |||

George E. Long, Jr.(10) | 21,477 | — | * | |||

All Directors and Executive Officers as a Group (17 Persons)(4)(11) | 346,382 | 61,925 | 2.46% | |||

|

9

| Name of Beneficial Owner | Common Stock | Restricted Stock Units | Percent of Class | ||||||||||||

Named Executive Officers:(4)

| |||||||||||||||

Thomas P. Meissner, Jr.(6)

| 65,145 | — | * | ||||||||||||

Christine L. Vaughan(7)(8)

| 6,020 | — | * | ||||||||||||

Todd R. Black(9)

| 27,985 | — | * | ||||||||||||

Laurence M. Brock(10)

| 13,584 | — | * | ||||||||||||

Christopher J. LeBlanc(11)

| 10,425 | — | * | ||||||||||||

Mark H. Collin

| 47,804 | — | * | ||||||||||||

All Directors and Executive Officers as a Group (19 Persons)(4)(12)

| 340,889 | 100,519 | 1.93% | ||||||||||||

| * | Represents less than 1% of the Company’s outstanding common stock. |

NOTES:

| (1) | Information obtained from the Schedule 13G/A filed by BlackRock, Inc. on behalf of itself, BlackRock (Netherlands) B.V., BlackRock Advisors, LLC, BlackRock Investment Management (UK) Limited, BlackRock Asset Management Canada Limited, BlackRock Asset Management Ireland Limited, BlackRock Asset Management Schweiz AG, BlackRock Financial Management, Inc., BlackRock Fund Advisors, BlackRock Institutional Trust Company, |

| (2) | Information obtained from the Schedule 13G/A jointly filed by |

| (3) | Information obtained from the Schedule |

| (4) | Based on information furnished to Unitil by its Directors and |

| (5) | Restricted Stock Units (“RSUs”) are granted to the Directors who have elected to receive RSUs in lieu of common stock as the equity portion of the annual retainer for Board service. RSUs will settle as 70% stock and 30% cash upon retirement or other separation from the Board. RSUs were granted |

|

10

| (6) | Included are |

Ms. Vaughan resigned as Senior Vice President, Chief Financial Officer & Treasurer of the Company on March 16, 2020. |

| (8) | Included are |

Included are |

| (10) | Included are 3,853 shares of unvested restricted stock granted under the terms and conditions of the Stock Plan. |

| (11) | Included are |

| (12) | Included are 1,171 shares that are held in trust for the Executive Officers under the terms of Unitil’s 401(k) and |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 (“Exchange Act”) requires the Company’s Executive Officers,our executive officers, Directors, and persons who own more than ten percent of a registered class of the Company’sour equity securities to file certain reports of ownership and changes in share ownership with the Securities and Exchange Commission (“SEC”) and the New York Stock Exchange (“NYSE”). Based upon itsour review of such forms that were filed in 2016,2019, and written representations from certain reporting persons that such forms were not required to be filed by those persons for the reporting year 2016, the Company believes2019, we believe that all filing requirements applicable to itsour officers and Directors during 20162019 and through February 2017,March 2020, were met.

|

11

TheUnitil’s Board and the Companymanagement are committed to comprehensive and effective corporate governance practices. The Board believes that good corporate governance is athe key to theour long-term success, ofand the Company, and essentialfoundation to ensureensuring that Unitilthe Company is operated in the best interest of shareholders and all other stakeholders. Accordingly, the Board has unconditionally adopted Corporate Governance Guidelines and Policies of the Board (the “Guidelines”), as described below, to assist Directors in the pursuit of superior Board function, effectiveness, communication and transparency in the governance of the Company. The Board and the Companymanagement believe that the ethical character, integrity and principles of the Board and senior management remain the most important safeguards of good corporate governance. Our RISE values indicate that solid governance practices are intrinsically woven into our Company culture and critical to long-term value creation and, ultimately, the sustainability of the Company.

The Guidelines represent the current view of the Board of Directors on governance and should not be viewed as rigid restraints. The CompanyWe will continue to monitor new developments and regulations, mandated by the SEC and by the NYSE, as well as emerging issues concerning corporate governance and financial disclosure, and will adopt changes and institute new policies, and procedures as appropriate. TheThese Guidelines are reviewed regularly and are subject to modification from time to time by the Board of Directors.Board. The Guidelines are available for review on the Corporate Governance page of the Investor Relations section of the Company’s website atwww.unitil.com/unitil.com/investors, and are available in print to any shareholder or other interested party free of charge upon request to the Corporate Secretary at1-800-999-6501 or at the address listed in the section entitledInformation about the Annual Meeting.

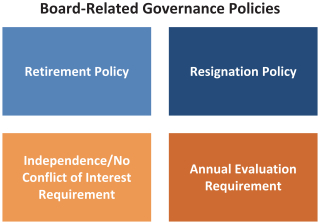

GOVERNANCE POLICIES OF THE BOARD

|

ROLE OF THE BOARD The Board is elected by the shareholders to oversee the long-term health and overall success of | ||

Unitil’s ultimate decision-making body shareholders or committees of the Board. In the pursuit of excellence in corporate governance, all members of the Board are expected to adhere to a set of core |

|

EXPECTATIONS OF DIRECTORS fulfill fiduciary duties to the Company and its shareholders with proper oversight of the development of Company policy and strategy, and assessment of the Company’s operational effectiveness and financial strength; apply superior business judgment and leadership, and effectively exercise the duties of loyalty and care; avoid any conflict of interest; promote a high standard of personal integrity and adhere to the letter and spirit of Unitil’s Code of Ethics; and challenge management to commit to the highest attainable goals, and hold management accountable for its commitments.

CODE OF ETHICS

The Company’s Code of Ethics (the “Code of Ethics”) is a statement of the Company’s high standards for ethical behavior, legal compliance and financial disclosure, and is applicable to all Directors, officers and employees of the Company and its subsidiaries. The Board unanimously approved the Code of Ethics in 2004, and annually affirms understanding of, and agreement and compliance with, the Code of Ethics. The Nominating and Governance Committee reviews the Code of Ethics annually for any required or desirable revisions. Should the Board adopt any changes to, or waivers of, the Code of Ethics, those changes or waivers will be promptly disclosed and posted on the Company’s website at the address noted below, as required by law, rule or regulation. A copy of the Code of Ethics can be viewed on the Company’s website atwww.unitil.com/investors.

Unitil’sOur Guidelines stipulate that a majority of the members of the Board, and all members of the Audit, Compensation and Nominating and Governance Committees, must be independent (as defined in Section 303A.02 of the NYSE Listed Company Manual—Corporate Governance Standards). As a listed

|

12

company on the NYSE, Unitilwe must adhere to the independence standards set forth by the NYSE, and the Board has formally adopted independence criteria corresponding to the NYSE rules for director independence. The NYSE Listed Company Manual includes additional independence requirements for Audit Committee and Compensation Committee members. In addition, Rule10A-3 of the Securities Exchange Act of 1934 (the “Exchange Act”) includes additional independence requirements for Audit Committee members.

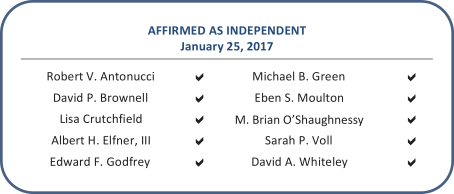

Our Corporate Governance Guidelines, as well as the NYSE independence standards, require that the Board annually affirm the independent status ofnon-employee or “outside” Directors. The Board makes this affirmation annually in January, and based on its last comprehensive review on January 29, 2020, the Board determined at that time, with the exception of Mr. Meissner and Mr. Collin, all of the current Board members are independent.

During its annual independence review and affirmation, the |  | Affirmed as Independent January 29, 2020 ✓ RobertV. Antonucci ✓ WinfieldS. Brown ✓ DavidP. Brownell ✓ LisaCrutchfield ✓ AlbertH. Elfner, III ✓ SuzanneFoster ✓ EdwardF. Godfrey ✓ MichaelB. Green ✓ EbenS. Moulton ✓ M.Brian O’Shaughnessy ✓ JustineVogel ✓ David A. Whiteley Dr. Antonucci, Mr. Brownell, Mr. Elfner and Mr. O’Shaughnessy will retire from the Board on April 29, 2020, pursuant to the Retirement Policy of the Board. | ||

| material changes in their relationships that may affect their independence status as determined by the Board. The obligation encompasses all relationships between Directors and Unitil and its subsidiaries and/or members of senior management. | ||||

During its annual independence review and affirmation, the Board applies the independence standards set forth in the Company’s Guidelines and by the NYSE. Under these requirements, the members of the Board who qualify as independent must be free from any material relationship that would interfere with the exercise of independent judgment as a member of the Board. An independent Director is one for whom the Board has affirmatively determined that he or she, individually or through a member of his or her immediate family, does not have or has not had management responsibility with the Company or otherwise been affiliated with the Company for the past three years and who has no material relationship with the

AFFIRMED AS INDEPENDENT January 25, 2017 Robert V. Antonucci Michael B. Green David P. Brownell Eben S. Moulton Lisa Crutchfield M. Brian O’Shaughnessy Albert H. Elfner, III Sarah P. Voll Edward F. Godfrey David A. Whiteley

Company, either directly or as a partner, shareholder or officer of an organization with such a relationship with the Company. This definition generally leaves the Board the discretion to determine, on acase-by-case basis, what constitutes a “material relationship” with the Company. The Board exercises this discretion in a manner that is consistent with applicable NYSE and SEC regulations and standards. In addition, members of the Board are obligated to notify the full Board of any material changes in their relationships that may affect their independence status as determined by the Board. The obligation encompasses all relationships between Directors and the Company and its subsidiaries and/or members of senior management.

The Board is responsible for the oversight of management, the development of Company policy and strategy, and the business affairsongoing assessment of the Company,Company’s operational effectiveness and financial strength, which includes the oversight of risk. The Board’s ultimate goals are to ensure that Unitil continues as a successful and sustainable business, to optimize financial returns in light of the business risks, to increase shareholder value over time, and to protect the interests of all stakeholders.

The Company has

|

13

We have a formal Enterprise Risk Management (“ERM”) program which is overseen byhas been in place since 2014. The Board has definitive oversight responsibility for the Board. ERM program in accordance with its fiduciary duty. Management provides the Board with a formal report annually, as well as with quarterly status updates, and any other updates as needed, which could include the identification of a new risk, or a change in risk velocity or mitigation strategy. The Board also receives a quarterly presentation on a specific risk topic selected from the ERM program for greater depth of understanding of the selected risk.

The ERM program is a foundation for risk management that is relevant, sustainable and scalable. The ERM program is designed to identify potential risks that may impact the Company,us, and to manage risks within the Company’sour risk appetite in order to sustain operations and achieve business and strategic objectives. In building the ERM program, the potential risks relating to the Company’sour business were defined using a comprehensive set of risk disclosures which are described inPart I, Item 1A. Risk Factors of the Company’sour 2019 Annual Report on Form10-K filed with the SEC on February 2, 2017.January 30, 2020.

The Board has assigned the Executive Committee the responsibility of assistingIn its oversight role, the Board in overseeing the overall risk management strategy of the Company. In order to assist the Board with overall risk management, the Executive Committee is supported by and oversees the Risk Managementand Compliance Committee which is comprised of the senior(the “RCC”), a multi-function management team. Together, these two committeescommittee created to provide recommendations on systems, policies and processes to achieve objectives, mitigate risk and ensure compliance. The RCC works with Mr. Meissner to evaluate and provide direction with respect to risk identification and assessment, and risk management and mitigation, including the specific guidelines and policies governing the process by which risk assessmentprocess. The RCC also works directly with functional managers on emerging risks and risk management are undertakenmitigation plans. The RCC provides quarterly reports on the status of the ERM program to the Board, as well as an annual report at the Company.strategic planning meeting.

Like all companies, Unitil faceswe face a variety of risks, both internal and external, and many factors work simultaneously to affect the Company’sour overall business risk. The Board recognizes that the Company’sour business risk is not static, and that it is not possible to mitigate all risk and uncertainty. The Board works within a climate of respect and candor, fostering a culture of open dialog between Board members and senior management.management, which includes comprehensive knowledge of Unitil’s many elements of risk. Overall, the Board believes that the ERM program has further defined and enhanced a systematic and proactive approach to properly oversee risk management has been defined and enhanced by the ERM program, which will continue to evolve through ongoing review and assessment of the existing and emerging risks facing the Company.

LEADERSHIP STRUCTURE

|

14

The current leadership structure of the Board consists of a combined Chairman/CEO position which has been held by Mr. Schoenberger since 1997. At this time, the Board believes that as asmall-cap domestic

corporation, the combination of these two positions is the optimal structure to guide the Company and maintain the focus required to achieve the Company’s long-term business goals. Mr. Schoenberger is the direct link between senior management and the Board, and as a utility professional with over 35 years of industry experience, he

The current leadership structure of the Board consists of a combined chairman and chief executive officer (“CEO”) position which has been held by Mr. Meissner since April 2018. At this time, the Board believes that as asmall-cap domestic corporation, the combination of these two positions is the optimal structure to guide the Company and maintain the focus required to achieve our long-term strategic goals. The CEO and president is the direct link between senior management and the Board. As a utility professional with over 30 years of industry experience, Mr. Meissner provides critical insight and perception to the Board, as well as valuable feedback to senior management, through his comprehensive understanding of the issues at hand. In July 2019, the Boardre-appointed Mr. Green to serve as the lead independent director (the “Lead Director”) for the coming year. In his role as Lead Director, Mr. Green, who also serves as the chair of both the Audit Committee and the Executive Committee, presides at all meetings of the Board in executive session. The Lead Director Charter outlines the responsibilities and expectations of the Lead Director. The existence and activities of the Lead Director do not alter the traditional roles and responsibilities of the Board as a whole, or Unitil’s management. | Lead Director Responsibilities & Expectations Leadership: Provide leadership and guidance to the Board on the fulfillment of its fiduciary duties, as well as the organization’s mission, vision, corporate governance and strategic direction. Meeting Management: Chair all meetings of the Board in executive session, as well as Board meetings at which the Chairman is not present. Encourage meeting participation, information sharing, and candid discussion with the goal of prudent decision-making and efficient and effective meetings. Relationship Management: Provide independent advice and counsel to the Chairman and CEO with particular emphasis on Board relations and matters of strategic importance; provide a communication conduit between the Board and the Chairman and CEO, as needed or requested. Corporate Governance: Facilitate, with the assistance of the Corporate Secretary, the annual board evaluation on key Board and committee-related matters. Board Culture and Conduct: Promote the continuation of a collegial and mutually respectful Board culture. Intervene, when necessary, in instances involving conflict of interest, confidentially, director performance, and other Board policies. |

The Board also has selected Mr. Elfner as the lead independent Director. In his role as lead Director, Mr. Elfner, who also serves as the chairman of the Executive Committee and as a member ofis engaged in ongoing succession planning, which is led by the Nominating and Governance Committee, presides at all meetings of the Board in executive session. Mr. Elfner also provides leadership and guidance to the Board on the fulfillment of its fiduciary duties, as well as matters of corporate governance. Mr. Elfner facilitates, with the assistance of the Corporate Secretary, results reporting to the Board with regard to the annual board evaluation on key Board and committee-related matters, and promotes the continuation of a collegial and mutually respectful Board culture. The existence and activities of the lead Director do not alter the traditional roles and responsibilities of the Board of Directors as a whole, or the Company’s management. As lead director, Mr. Elfner shall undertake any other action or exercise such other powers, authority, duties, and obligations as necessary or appropriate or as otherwise required by the listing standards of the NYSE or other applicable laws, rules or regulations, or as shall otherwise be determined by the Board.

RETIREMENT POLICY

Committee. The Board has a retirement policy that provides noSuccession Plan addresses upcoming retirements, committee membership and rotation, class balancing, skill set requirements and gaps, and planning for unforeseen events. The Board Succession Plan is also linked to both new director recruitment actions and diversity goals.

|

15

No Director may be nominated as a candidate or for reelection,re-election as part of the slate of Directors proposed for election by the Company,that we propose, nor may any person be nominated as a candidate for Director,election, after he or she has reached age 75. Directors are not, however, subject to specific term limits. Due to the complexity of the utility industry, the Company valueswe value the insight that a Director is able to develop over a period of time. The Board believes that tenure provides an enhanced contribution to the Board, including the benefits of valuable experience and familiarity, which is in the best interest of shareholders.

DIRECTORS’ STOCK OWNERSHIP AND RETENTION POLICY

The Board has a mandatory stock ownership policy that is applicable to all members of the Board. The Board is of the continuing beliefbelieves that its members should own a significant number of shares of the Company’sUnitil common stock to properly align their interests with those of the shareholders of the Company. Effective as of January 1, 2013, allour shareholders. Allnon-employee Directors must own shares of the Company’sUnitil common stock in the equivalent value of three times the current annual cash retainer for Board service. Shares of restricted stock and restricted stock units (“RSUs”) are counted towards this total. The ownership requirement is calculated annually on January 1, and as of January 1, 2017,2020, the ownership requirement wasis currently $195,000 in value. Currently, all Board membersDr. Antonucci, Mr. Brownell, Mr. Collin, Ms. Crutchfield, Mr. Elfner, Mr. Godfrey, Mr. Green, Mr. Moulton, Mr. O’Shaughnessy and Mr. Whiteley meet the stock ownership requirement. Any new Director who may joinjoins the Board in the future will havehas four years from the date of first election to the Board by shareholders to accumulate the required number of shares of common stock.

RESIGNATION POLICY

In October 2016,stock, which currently applies to Mr. Brown, who is standing for election at the Annual Meeting, as well as Ms. Foster and Ms. Vogel, both of whom were elected to the Board adoptedat the 2019 Annual Meeting. Additionally, all members of the Board are required to hold all forms of equity received from the Company until retirement or other separation from the Company. For Board members, this includes all forms of equity received as part of the annual retainer for Board service. The Board, in its sole discretion, may approve a waiver to this policy that requires aas circumstances may warrant. To date, no such waivers have been proposed or approved.

A Director is required to tender his or her resignation if he or she should receivereceives a “withhold” vote greater than 50% of the shares voted at the annual meeting of shareholders in an uncontested election. If an incumbent Director fails to receive the required vote forre-election, the Nominating and Governance Committee will act on an expedited basis to determine whether to recommend the acceptance of the Director’s resignation and will submit such recommendation for prompt consideration by the Board. The Director whose resignation is under consideration shall abstain from participating in any decision regarding that resignation. The Nominating and Governance Committee and the Board may consider any factors they deem relevant in deciding whether to accept a Director’s resignation.

Further, theThe Board shall nominatenominates for election orre-election as Directorto the Board only candidates who agree to tender, promptly following the annual meeting at which they are electedface election orre-electedre-election as Director, irrevocable resignations that will be effective upon (i) the failure to receive the required vote at the annual meeting at which they facere-election and (ii) Board acceptance of such resignation. In addition, the Board will fillfills board seat vacancies and new directorships only with candidates who agree to tender, promptly following their

|

16

appointment to the Board, the same form of resignation tendered by other Directors in accordance with this policy.

ANNUAL EVALUATION

The Board conducts an annual evaluation on key Board- and committee-related issues, an exercise that has been practiced since 2002. The annual evaluation has proven All candidates proposed for election orre-election at the Annual Meeting have agreed in writing to be a beneficial tool in the process of continuous improvement in Board and committee functioning and communication. The evaluation is specifically designed to provide a platform for qualitative expression of thoughts and opinions, as well as a catalyst for candid discussion and open dialog on current and emerging issues facing the utility industry, the Board as a whole, any committee(s) served upon, matters of strategic importance to the Company, as well as self-evaluation with regard to skills and expertise. In 2016, all Directors participated in the annual evaluation, which was conducted in the fourth quarter. Responses were discussed in executive session in January 2017.abide by this policy.

MEETING ATTENDANCE

The Board isDirectors are expected to make a determined effort to attend all meetings of the Board and applicable committees upon which they serve. In 2016,2019, the Board held four meetings, and theits committees held 19 meetings. Overall, Directors attended 99%a total of the36 meetings, held in 2016.collectively. No Director attended less than 75% of the aggregate of the total number of meetings of the Board and applicable committees.

In 2019, the Directors achieved perfect attendance with all Directors attending 100% of the meetings held in 2019. Directors are encouraged to attend the Annual Meeting, although there is no formal requirement to attend. In 2016, all eleven2019, thirteen Directors attended the annual meeting of shareholders.

EXECUTIVE SESSIONS

Non-employee members of the Board have the opportunity to meet in executive session, without members of management present, either prior to the start or following the adjournment of each Board and committee meeting. During 2016,2019, the Board met in executive session on four occasionsoccasions. Mr. Green, the Lead Director, presided at all four meetings.

Our Code of Ethics (the “Code of Ethics”) is a statement of our high standards for ethical behavior, legal compliance and financial disclosure, and is applicable to all of our Directors, officers and employees. The Board unanimously approved the Code of Ethics in 2004, and along with all management personnel, annually affirms understanding of, and agreement and compliance with, the Code of Ethics. The Nominating and Governance Committee reviews the Code of Ethics annually for any required or desirable revisions. Should the Board adopt any changes to, or waivers of, the Code of Ethics, those changes or waivers will be promptly disclosed and posted on our website at the address noted below. To date, there have been no changes to or waivers requested or granted with regard to the Code of Ethics. A copy of the Code of Ethics can be viewed on our website atunitil.com/investors.

MANAGEMENT SUCCESSION PLANNING

Effective executive leadership is critical to our success. The Board oversees the senior management succession planning process to ensure that effective plans are in place for succession of the CEO, as well as other senior management positions. The succession plan addresses contingencies for retirement, resignation, death, disability, or other untimely departure of the CEO and/or other members of senior management for a smooth transition on both an interim and long-term basis. In 2019, the management

|

17

succession plan was evaluated for gaps and other risk factors. As a result of that evaluation, in 2020, the management succession plan will be expanded and developed further to include middle management and other key positions, including long-serving employees nearing retirement.

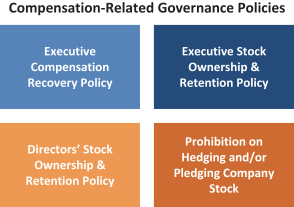

EXECUTIVE COMPENSATION RECOVERY POLICY

In the event we are required to prepare an accounting restatement of our financial statements due to the material noncompliance with any financial reporting requirement under the securities laws, we shall be entitled to recover any excess performance-based compensation received by any current or former covered executive during the three-year period immediately preceding the date on which we are required to prepare an accounting restatement. To the extent allowed by applicable law and the lead Director, Mr. Elfner, presidedlisting standards of the New York Stock Exchange, we may seek to recover any such excess performance-based compensation at these meetings.the direction of the Compensation Committee after consideration of the costs and benefits of doing so, and as approved by Board.

“Performance-based compensation” includes all annual incentives andlong-term incentives (whether in cash, in equity, or otherwise) with performance features based on Unitil’s or a group’s performance, the award or size of the award of which was contingent upon such performance. The policy does not apply to restatements that the Board determines are required or permitted under generally accepted accounting principles in connection with the adoption or implementation of a new accounting standard or caused by our decision to change one or more accounting practices as permitted by applicable law. |  |

EXECUTIVE STOCK OWNERSHIP POLICY

| Chairman, CEO and President | 4X | All Named Executive Officers are required to own shares of our common stock in the equivalent value of a multiple of base salary. All shares of our common stock that are owned directly | ||||||||

Chief Financial Officer | 3X | |||||||||

All Other Named Executive Officers | 2X |

or beneficially, shares of restricted stock that are awarded, whether vested or unvested, as well any shares of Unitil common stock held in the Tax Deferred Savings and Investment Plan will be counted towards the required total. Any newly appointed Named Executive Officer will have four years from the date of appointment to obtain the required shares of stock. The required equivalent value for all Named Executive Officers will be recalculated annually on January 1. Any executive officer who may regress into a shortfall position as a result of the January 1 recalculation after expiration of the initialphase-in period will have until December 31 of that calendar year to meet the new required equivalent value. All current Named Executive Officers as of the date of this proxy statement have met the ownership requirement.

|

18

EXECUTIVE STOCK RETENTION POLICY

The Board believes that our executive officers should own a significant number of shares of our common stock to properly align their interests with those of the shareholders. All Named Executive Officers are required to hold all forms of equity received as compensationuntil retirement or other separation from the Company. The Board, in its sole discretion, may approve a waiver to this policy as circumstances may warrant. To date, no such waivers have been proposed or approved.

PROBITION ON HEDGING AND/OR PLEDGING COMPANY STOCK POLICY

All members of our Board and our executive officers are prohibited from engaging in short sales or engaging in any hedging transaction with respect to our common stock, as well as engaging in any transactions that result in pledging, or using as collateral, shares of our common stock in order to secure personal loans or other obligations, including any shares that may be a margin account.

COMMUNICATION WITH THE BOARD

Shareholders and other interested parties who desire to communicate with the Board, a committee of the Board, thenon-management or independent Directors as a group, or an individual member of the Board may do so in writing by sending a letter c/o Corporate Secretary, Unitil Corporation, 6 Liberty Lane West, Hampton, New Hampshire 03842-1720 or via email towhitney@unitil.com. The CompanyCorporate Secretary will screen suchall correspondence for security purposes. The Corporate Secretarypurposes, and will also determine whether the communication relates to business matters that are relevant to us. If the Company and, if so,correspondence meets these standards, it will be promptly forward the communicationforwarded to the appropriate Director(s).

NOMINATIONS

The Nominating and Governance Committee is responsible for recommending to the Board the slate of Director nominees for election by our shareholders. The Board reviews and, as appropriate, approves all Director nominees prior to annual proxy material preparation.be presented to our shareholders for election. As provided in Article III of the Company’sour Bylaws, any vacancy occurring in the Board, whether due to the death, resignation or other inability to serve of any Director previously elected may be filled by the affirmative vote of a majority of the remaining Directors. A Director elected to fill a vacancy shall be elected for the unexpired term of his or her predecessor in office.

General Nomination Process

The Nominating and Governance Committee determines the required selection criteria and qualifications of Director nominees based upon the needs of the Company at the time nominees are considered. See also the section entitledCorporate Governance PoliciesQualifications and Skills of the Board — Board DiversityDirectorsbelow. Director candidates will be selected based on input from Directors, Executive Officers,executive officers, and if the Committee deems appropriate, a third-party search firm. Minimum criteria for Director nominees are set forth below, as well as in the Corporate Governance

|

19

Guidelines. A candidate must possess the ability to apply good business judgment and must be in a position to properly exercise his or her duties of loyalty and care. Candidates with potential conflicts of interest or who do not meet independence criteria will be identified and disqualified, as appropriate. In addition, to independence criteria, the Committee will consider criteria including integrity, judgment,independence, proven leadership capabilities, business experience, areas of expertise, availability for service, factors relating to the composition of the Board, such as size, and structure, and also the Company’s policies and principles concerning diversity. The Board seeks to include diversity of backgrounds, perspectives, experience and skills among its members. The Committee will consider these criteria for nominees identified by the Committee, by other Directors, by shareholders, or through another source. When current Board members are considered for nomination for reelection, the Committee also takes into consideration their prior Board contributions, performance, and meeting attendance records.

The Committee conducts a process of makingmakes a preliminary assessment of each proposed nominee based upon thehis or her resume and biographical information, an indication of the individual’shis or her willingness to serve and other background information. This information is evaluated against the criteria set forth above as well as theour specific needs ofat the Company at that time. Based upon a preliminary assessment of the candidate(s), those who appear best suited to meet theour needs of the Company may be invited to participate in a series of interviews, which are used for further evaluation. On the basis of information collected during this process, the Committee determines which nominee(s) to recommend to the Board for approval to submit for election at the next annual meeting of shareholders, or to fill vacancies on the Board that occur between shareholder meetings. The Committee uses the same process for evaluating all nominees, regardless of the source of the nomination. The Board may elect, at its discretion, to participate in an additional round(s) of interviews with one or all candidate(s) recommended by the Committee.

Director Candidate Identification and Selection Process in 2019

As part of the Board’s defined succession planning process, the Nominating and Governance Committee began a comprehensive search for a new Board member inmid-2019 with the primary directives of identifying qualified candidates with a connection to our local communities and service areas, proven senior leadership experience, financial acumen, and gender diversity. The Committee identified a reasonably large group of potential candidates with some or all of the desired characteristics using recommendations from the Board and also from senior management. The Committee reviewed the larger list for conflicts of interest and independence concerns, as well as to gauge the general interest of the potential candidate(s) in a seat on the Board, and based on the results of that exercise, narrowed the list to two candidates.

The Committee instructed Mr. Meissner to initiate contact with both candidates and to conduct preliminary interviews. Mr. Meissner produced a candidate assessment report for each candidate inmid-September for the Committee’s review. The Committee agreed, based on Mr. Meissner’s candidate assessment reports, that both candidates were well qualified by way of their own professional accomplishments, as well as possessed at least three of the four skills and attributes defined as primary directives. Formal interviews with the Committee and Mr. Meissner occurred in late October with both candidates, and a final candidate was identified to be recommended for election to the Board in January 2020.

In January 2020, the Board approved the Committee’s recommendation and elected Mr. Brown to the Board to stand for election by our shareholders at the Annual Meeting. Expanded biographical information for Mr. Brown is included in the section entitledProposal 1: Election of Directors.

|

20

The Board believes the Committee’s dedicated actions and well-planned process produced an outstanding result with the identification and recommendation of a highly qualified candidate with varied and extensive experience in a number of important areas that will enhance and preserve the Board’s existing strong skill set. The Board is dedicated to the importance of diversity in all respects, including professional experience and unique skill sets, age, and gender for sustainability in the long-term and ongoing value creation for our shareholders.

Shareholder Nominations

Shareholders who wish to recommend a nominee for consideration by the Committee may do so by sending the following information to the Committee c/o the Corporate Secretary at the address listed in the section entitledCorporate Governance – Governance Policies of the Board—Communication with the Board: (1) the name of the candidate with brief biographical information and his or her resume; (2) contact information for the candidate and a document evidencing the candidate’s willingness to serve as a Director if elected; and (3) a signed statement as to the submitting shareholder’s current status as a shareholder and proof of ownership of the number of shares currently held.

Additionally, nominations of persons for election to the Board may be made by any shareholder of the Company by submitting a nomination in compliance with all procedures set forth in Article IV –Nomination of Directors of the Company’s

Additionally, nominations of persons for election to the Board may be made by any of our shareholders by submitting a nomination in compliance with all procedures set forth in Article IV –Nomination of Directors of our Bylaws. No candidates for Director nominees were submitted to the Committee by any shareholder in connection with the Annual Meeting. Our shareholders are entitled to certain rights by law as well as those granted in our Bylaws and Articles of Incorporation. | Shareholder Rights We do not have classes of stock with unequal voting rights. All shareholders are entitled to vote for all current director nominees. We do not have a poison pill in effect. No shareholder has a preemptive right. The Board is authorized to issue only shares of common stock, no par value; no preferred stock is authorized. Our Articles of Incorporation and ourby-laws may be amended by shareholders with a simple majority vote. Shareholder approval is required to materially modify our capital structure. |

|

21

The Board believes there are general qualifications that all Directors must exhibit, and other qualifications, attributes, skills and experience that should be represented on the Board as a whole, but not necessarily by each Director.

Qualifications Required of All Directors

The Board requires that each Director be a person of high integrity and superior ethical character with a proven record of leadership and accomplishment in his or her chosen field. Each Director must demonstrate innovative and independent thinking, understand complex principles of business, finance, and utility regulation, and demonstrate familiarity with and respect for corporate governance requirements and practices. Directors must also comply unequivocally with the Code of Ethics, and be free of conflicts or potential conflicts of interest, and other than Mr. Schoenberger,a sufficient number of Directors must meet the requirements of independence as set forth by the NYSE, as appropriate. Directors must be willing and able to dedicate the proper amount of time and effort to service on the Board as necessary to fulfill his or her responsibilities to the Company,as a Director, and must not serve on more than two public company boards if currently holding a position of chief executive officer or an equivalent position, or on more than three public company boards if serving in an alternate role, or if retired.

Qualifications, Attributes, Skills and Experience to be Represented on the Board

The Board has identified particularcertain qualifications, attributes, skills, experience and experiencebackground that it believes are important to be represented on the Board as a whole.Board. The Nominating and Governance Committee is charged with the responsibility of tracking the Directors’ professional experience and skill sets with a board inventory matrix (the “Skills Matrix”). The Skills Matrix lists each Director and his or her professional experience and skill sets in categories considered by the Board and the Committee to be advantageous to the regulated utility business, as well as for a company of Unitil’s size and complexity. The Committee uses this information to assess overall Board composition and to identify existing and potential gaps in the skill sets of Directors. This information is also used for recruiting purposes when there is a vacancy, or an expected vacancy, on the Board. The Skills Matrix has proven to be a valuable tool in this assessment exercise. The Board strives to represent a meaningful cross-section of business and industry experience, education, and specialized skill sets with a group of diverse individuals who add the element of quality to the Company’s corporate governance framework, and who fairly and without compromise execute their fiduciary duty to serve the best interests of Unitil’s shareholders and all of the Company’s stakeholders.

responsibility of tracking the Directors’ professional experience and skill sets with a board inventory matrix (the “Skills Matrix”). The Skills Matrix |

| |

| group of | ||

|  |

|

22

The Skills Matrix Summary outlines certain essential key qualifications and experience that the Board believes should be represented on the Board for optimal oversight of our business and the effective exercise of its fiduciary duty to shareholders. Directors standing for reelection are also evaluated by the Committee for recommendation to the Board using a set procedure based on the expectations of Board members, which is provided to all members of the Board and reviewed annually. The evaluation includes contribution to the Board and committees served upon; unique skills, expertise and attributes; attendance and preparedness; and willingness to continue serving. Overall continuity and chemistry of the Board are also considerations, as well as factors relating to the composition of the Board, such as size and structure, and also the diversity of backgrounds, perspectives, experience and skills among its members. Lengthy tenureTenure on the Board is considered to be a uniquely valuable qualification in the highly regulated utility industry.

In July 2019, the Nominating and Governance Committee conducted an exercise with the full Board to review and update the Skills Matrix. The exercise involved a self-evaluation by each Board member concerning what they perceive to be their own primary and secondary skills within the Skills Matrix. The findings of the exercise were evaluated and discussed by the Committee, and as a result, several new skills were added to the Skills Matrix. The exercise also defined the Board’s strongest skills sets asC-Suite experience, financial expertise, strategic planning, and utility operations and regulation.

Although the Board does not have a formal diversity policy, it does seek to maintain optimum Board heterogeneity through an appropriate balance of diversity of backgrounds, perspectives, tenure, professional experience and skills among its members. The Board believes that a variety of points of view and experiences contributes to a more effective decision-making process, and considers diversity of gender, age, competencies, and professional experience in the evaluation of all candidates for Board membership. The Board also considers how the experience and skill set of each Director nominee complements those of existing Directors and fellow Director nominees to create a balanced Board with diverse viewpoints and deep expertise.

| Although the Board does not have a formal diversity policy, it believes that diversity, including gender diversity, is essential for a well-functioning board, the creation of shareholder value, and ultimately, the sustainability of Unitil over the long term. The Board seeks to maintain optimum Board heterogeneity | ||

| through an appropriate balance of diversity of backgrounds, perspectives, tenure, professional experience and skills among its members. The Board feels strongly that a variety of points of view and experiences contribute to a more effective decision-making process, and considers diversity of gender, age, competencies, and professional |

| |

| experience in the evaluation of all candidates for Board membership. The Board also considers how the experience and skill set of this year’s new Director nominee complements those of existing Directors and fellow Director nominees to create a balanced Board with diverse viewpoints and deep expertise. The Board’s expected diversity profile following the Annual Meeting is illustrated above. | ||

Skills Matrix Summary Utility Operations CEO/Senior Leadership Experience High Level Financial Aptitude Utility Regulation Regional Knowledge/Expertise Public Policy

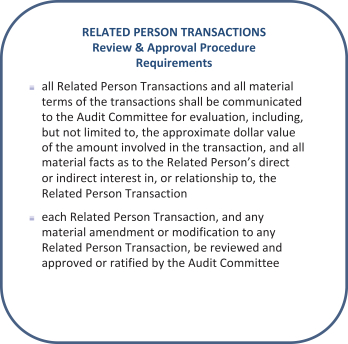

TRANSACTIONS WITH RELATED PERSONS

The Audit Committee is responsible for reviewing and approving, as appropriate, all Related Person Transactions (as defined below), in accordance with its charter (the “Audit Committee Charter”). As a result, the Audit Committee has adopted procedures for such review and approval and included such procedures in the Company’s our

|

23

Corporate Governance Guidelines. The CompanyUnitil had no Related Person Transactions in 2016,2019, and there are no Related Person Transactions currently proposed for 2017.2020. A “Related Person Transaction” means any transaction for which disclosure is required under the terms of Item 404(a) of SEC RegulationS-K involving the Company and any Related Person. A “Related Person” is defined in Item 404(a) of SEC RegulationS-K.

Transactions between the CompanyUnitil or one or more of its subsidiaries and one or more Related Persons (as defined below) may present risks or conflicts of interest or the appearance of conflicts of interest. The Company’sOur Code of Ethics generally requires all employees, officers and Directors without exception, to avoid engagement in activities or relationships that conflict, or would be perceived to conflict, with the Company’sour interests or adversely affect itsour reputation. It is understood, however, that certain relationships or transactions may arise that would be deemed acceptable and appropriate upon full disclosure of the transaction, following review and approval to ensure there is a legitimate business reason for the transaction and that the terms of the transaction are no less favorable to the Companyus than could be obtained from an unrelated person.

RELATED PERSON TRANSACTIONS Review & Approval Procedure Requirements

◾ all Related Person Transactions and all material terms of the transactions shall be communicated to the Audit Committee for evaluation, including, but not limited to the approximate dollar value of the amount involved in the transaction, and all material facts as to the Related Person’s direct or indirect interest in, or relationship to, the Related Person Transaction ◾ each Related Person Transaction, and any material amendment or modification to any Related Person Transaction, must be reviewed and approved or ratified by the Audit Committee | RELATED PERSON TRANSACTIONS Basis for Audit Committee Evaluation of Transactions ◾ information provided by members of the Board during the required annual affirmation of independence, at which the members of the Audit Committee will be present ◾ applicable responses on Directors’ and Officers’ Questionnaires submitted by Directors and officers and provided to the Audit Committee by the Corporate Secretary or Internal Auditor ◾ background information on nominees for Director provided by the Nominating and Governance Committee ◾ any other applicable information provided by any Director or officer of the Company | |||

In connection with the review and approval or ratification, if appropriate, of any Related Person Transaction, the Audit Committee will consider whether the transaction will compromise the Company’sour professional standards included in its Code of Ethics. In the case of any Related Person Transaction involving an outside Director or nominee for Director, the Audit Committee will also consider whether the transaction